There’s no legal sports betting in California, though Super Bowl-sized loopholes — in the form of new “prediction market” platforms — are allowing anyone across America to wager on games anyway.

Companies such as Kalshi and Polymarket have made a big push into every state, including those where sportsbooks are banned, by offering customers the opportunity to buy and sell “contracts,” not bets — even as critics argue it’s simply repackaged sports gambling.

The prediction markets’ expansion into California — where the Super Bowl will take place Sunday — lays bare the murky, legally ill-defined question of what constitutes a bet.

“I think there’s a good chance that [federal courts] will let this continue for at least a couple more years,” said I. Nelson Rose, a specialist in gaming regulations and law professor emeritus at Whittier College in California.

“I mean, California actually has a 100-year-old statute that makes it a misdemeanor to accept, record or even make a bet on a sports event. And yet, here we are now.”

The scale of activity around this year’s Super Bowl helps explain why prediction markets have drawn such scrutiny. Kalshi said trading volume on its Seattle–New England Super Bowl market had surpassed $161 million as of Tuesday evening, with nearly 70% of traders favoring Seattle. That’s more than six times the volume Kalshi recorded on its Super Bowl winner market last year, a jump it attributed to the rising popularity of prediction markets.

When is a bet a bet?

Kalshi and Polymarket platforms work by allowing users to buy and sell event contracts on financial exchanges the companies facilitate and charge fees to use. A winning contract pays out $1, so if you bet 20 cents and win, you would net an 80-cent profit, minus the company’s transaction fee. Unlike traditional sportsbooks, which typically lock bettors into wagers, prediction market users can trade in and out of positions before events are settled, limiting losses or locking in profits.

The companies argue that because they don’t take the opposite side of bets or profit directly from customer losses, the model is fundamentally different from traditional sports gambling. A bookmaker acts as the “house” and earns money by taking an 11-to-10 commission — known colloquially as the “juice” or “vigorish” — off bets.

“That’s totally different than gambling, because you’re trading with an equal counterparty on a federally regulated exchange, and you’re not betting against the house,” former Rep. Sean Patrick Maloney, D-N.Y., who now leads the Coalition for Prediction Markets, an industry group for prediction markets that advocates for federal oversight of the markets, told NBC News.

Kalshi and Polymarket didn’t respond to repeated requests for comment on this article. Both companies have consistently maintained that their platforms don’t constitute gambling.

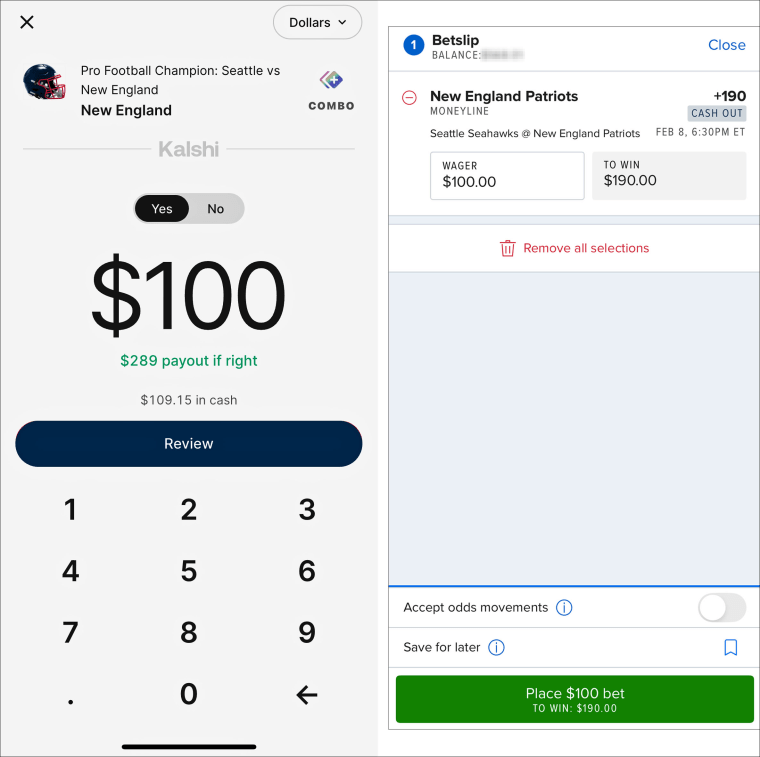

At first glance, the user experiences on prediction market apps and conventional sports gambling sites seem remarkably similar.

A $100 investment on the New England Patriots via Kalshi would bring a $289 payout — a $189 profit — should the AFC champs score a mild upset of the Seahawks next week.

Meanwhile, a $100 New England wager on the sportsbook FanDuel, which is illegal in California, would bring a $190 net for Patriots backers — so basically the same financial proposition, with the former transaction being allowed in California and the latter geofenced off.

While sportsbooks like FanDuel make money from losing bets, prediction markets don’t take positions on games, and they earn money through transaction fees when customers buy or sell contracts.

“It’s basically a financial market,” said Koleman Strumpf, an economics professor at Wake Forest University. “They provide a platform, and the platform allows you to bet against other people.”

So far, that has given prediction markets enough wiggle room to continue. Critics, however, say it’s a distinction without a difference.

“They’re a bunch of gamblers,” said Dennis Kelleher, president and CEO of Better Markets, an advocacy group that claims prediction markets evade state taxes and consumer protection laws that rule over traditional sports gambling operations.

“They’ve just figured out if we call it an event contract, then we can avoid being regulated like everybody else.”

Kalshi recently boasted that its service “brings 100% legal sports trading to all 50 states” in a 923-word statement in which the words “bet,” “betting,” “gamble” and “gambling” never appear.

But the company described itself in some ads last year as “the first app for legal sports betting in all 50 states,” singling out residents in California and Texas, where sports gambling is also illegal.

How did California become a sports bet desert?

The rise of prediction markets is the latest chapter in the uncharted wild west of sports betting — which is likely to have its biggest day of the year when the Super Bowl comes to California on Sunday.

While the prediction market apps initially focused on making predictions on political events like elections, the companies have rapidly expanded into sports, providing new avenues for making wagers in states that ban or heavily restrict sports gambling.

Online sportsbooks have spread like wildfire since a 2018 U.S. Supreme Court ruling allowed states to set their own rules on that form of gambling. There’s now some form of sports betting in 39 states and the District of Columbia.

California is the largest state where it remains illegal, and voters have doubled down on that position: In 2022, Californians overwhelmingly rejected a ballot proposition to bring sports gambling to Native American casinos.

Proposition 27, which would have legalized online sports betting, lost by an even wider margin of 83% to 17%.

While prediction markets may be gaining traction among California residents, they are still relatively new and don’t have the massive marketing presence and sponsorship deals of sportsbooks like FanDuel or DraftKings.

Many older gamblers are wary of opening prediction market accounts, said Victor Rocha, conference chairman of the Indian Gaming Association.

“It’s aimed towards the young males and is still a fintech product that’s trying to become a sports betting product,” Rocha said. “I still think that has [older] people a bit mystified.”

Prediction market companies say they fall under the regulation of the federal Commodity Futures Trading Commission (CFTC), rather than state governments, which tax and regulate gambling.

Kalshi sued the CFTC in 2023 when it prohibited the company from listing contracts on American election results. In a landmark 2024 court ruling, a federal judge in Washington, D.C., sided with Kalshi. With that court ruling and the departure of Biden administration officials who actively tried to restrict prediction markets, the industry quickly ramped up.

Last week, the head of the CFTC announced the agency’s intention to support the “responsible development” of prediction markets, stressing “the important role they play in the broader financial system.”

Some states are pushing back. Massachusetts and Nevada have filed sued, and nine other states have sent cease-and-desist letters to the companies, arguing that prediction markets are offering illegal, unlicensed sports gambling.

New York Attorney General Letitia James also issued a consumer warning ahead of the Super Bowl, saying prediction market products bets are “masquerading” as event contracts and cautioning that they lack the same consumer protections as regulated gambling platforms.

“It’s crystal clear: so-called prediction markets do not have the same consumer protections as regulated platforms,” James said in a statement Monday, urging consumers to be cautious about placing trades on the sites.

Maloney said the pushback reflects a broader misunderstanding of how prediction markets work and why they exist, adding that his coalition is “calling for strong federal regulation” rather than “a patchwork of state-by-state regulations.”

California, by contrast, has remained mostly on the sidelines — despite the state’s own prohibition against sports gambling.

The state’s attorney general filed a legal brief supporting three Native American tribes in California suing Kalshi, arguing that the company is violating federal gaming laws by making its prediction market available on tribal lands.

California hasn’t taken legal action against prediction markets in the state and is instead “actively monitoring the nationwide litigation on this issue,” the state Justice Department said in a statement.

Representatives of Gov. Gavin Newsom and the state Gambling Control Commission both declined to comment.

‘It feels the same’

Even as the legal fights play out, the prediction markets are rapidly gaining new customers, who probably don’t see much of a difference between their apps and the better-known sportsbooks.

A 25-year-old prediction market user in Santa Barbara, California, said he has no illusions about what he’s doing, telling NBC News that he’s clearly placing bets on games.

“It’s sports gambling, that’s what it is,” the man, who regularly uses Polymarket, Kalshi and DraftKings Prediction Markets, said in a phone interview. “There’s no need to beat around the bush.”

The user, who trades under the name “Uncle Rico” and declined to share his name because of privacy concerns, said the experience can feel virtually indistinguishable from a sportsbook, especially as more traditional betting brands expand into prediction-style products.

“It looks the exact same and it feels the same, like it is the same thing,” he said of the new DraftKings prediction app he uses in California.

For him, the distinction is less about whether it’s gambling — and more about how it’s structured.

Traditional sportsbooks, he said, are “taking 10% off top,” which in his view makes it difficult for casual bettors to win over time. With prediction markets, he added, “if you take back that 10% edge,” the bar to profitability drops.

Still, even he acknowledged that prediction markets in California can feel more limited than a full sportsbook menu: “When I’m in California ... the menu is reduced by 50%,” he said, compared with states where sportsbooks offer far more player props and niche bets.

The future of sports betting

If prediction markets take off in California, it could lead to a new scramble to capitalize on the state’s large pool of potential sports bettors.

Nathan Click, spokesperson for the losing Prop. 27 effort in 2022, cited a poll in August that appeared to show a majority of Californians articulating some degree of support for sports gambling.

While 25% of respondents believe it’s “long overdue” to legalize online sports betting in California, 35% of those interviewed said it “might make sense to legalize and regulate the industry,” according to the University of California, Berkeley, Citrin Center-Politico poll.

“Sports betting is already happening in the state, just in unsafe, illegal bookies and with offshore online operators,” Click said.

Fanatics Sportsbook CEO Matt King, whose company operates both a traditional sportsbook and a separate prediction market product, argued that is precisely why regulated legal options matter.

“Activities like this exist no matter what,” he said, pointing to what he described as the “massive” scale of illegal sports betting in the U.S.

“We operate in regulated businesses,” he continued, adding that legal options can offer protections consumers don’t get in illegal or offshore markets.

Fanatics isn’t alone in straddling both sides of the sports betting–prediction market divide. DraftKings, one of the largest sportsbook operators in the U.S., launched its own prediction market product, DraftKings Predictions, in December under federal oversight from the CFTC.

Jeanine Hightower-Sellitto, general manager of DraftKings Predictions, said the company views its prediction market offering as part of a separate, federally regulated framework — not a workaround to state gambling laws.

“If a federally regulated framework exists and customers want to trade within it, then it’s available to them,” Hightower-Sellitto said. “No one is forced to participate.”