The federal government wants the money it sent dead people returned.

The Internal Revenue Service on Wednesday updated its website to say that people who have died do not qualify for the coronavirus relief payments and that: "A Payment made to someone who died before receipt of the Payment should be returned to the IRS."

The Treasury Department also tweeted the same Wednesday.

Before that, it was unclear whether the payments, which amounted to as much as $1,200 for individuals, needed to be repaid.

NBC News talked to people in April whose deceased loved ones got direct deposits from the relief package, which was authorized by Congress as part of a $2 trillion package.

The Treasury Department called the payments to deceased people as well as those who are incarcerated as inadvertent.

Experts have said that because of a lag in reporting data on who is deceased, the error is almost inevitable and has occurred with past stimulus payments as well, The Associated Press reported this week.

Even before the formal guidance Wednesday, Jeanne Siracuse of northern Virginia planned to return to the Treasury the $1,200 that was direct deposited for her mother who died in August.

"We don't want it," Siracuse said at the time. "It's not who this stimulus was supposed to benefit."

The coronavirus payments were largely based on 2018 or 2019 federal tax returns. Social Security recipients did not have to file a tax return to get a payment.

Congress passed the CARES Act that authorized the direct payments as well as other measures in March, and President Donald Trump signed it into law.

The package was sparked by economic devastation wrought by the coronavirus epidemic, which resulted in businesses across the nation being shuttered.

Around 3.8 million more workers filed for first-time employment benefits in late April, bringing the national jobless total to a staggering 30 million — or around 18 percent of the workforce.

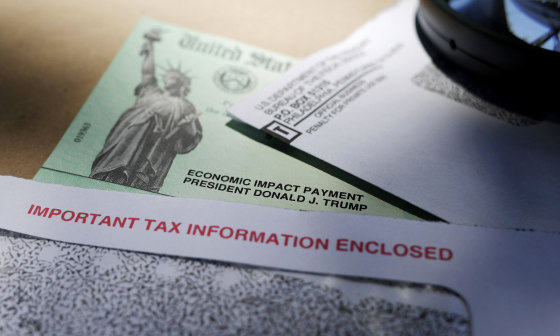

The IRS said last week that more than 130 million "Economic Impact Payments" totaling more than $207 billion have been delivered to Americans in less than 30 days.

The payments are made in direct deposit or via paper checks. People who need to return paper checks are told to write "void" in the endorsement section before mailing them to IRS addresses based on where they live. If those have already been cashed, the IRS has instructions on how to return those payments in its website.