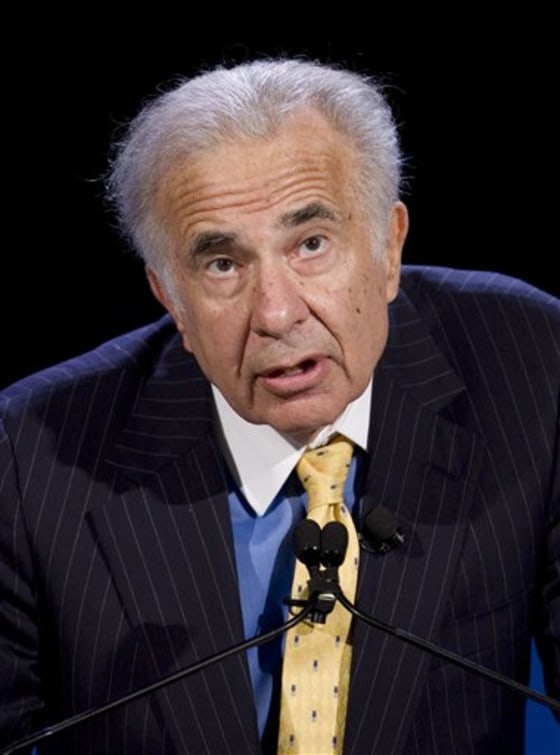

Commercial lender CIT Group Inc. said Friday that billionaire investor and bondholder Carl Icahn agreed to support the company's restructuring plan amid reports CIT may soon file for bankruptcy protection.

Icahn also agreed to provide CIT with a $1 billion line of credit.

Icahn has been an outspoken critic in recent weeks of New York-based CIT Group's plan to restructure its debt in an effort to avoid collapse. CIT, one of the largest lenders to small and midsize businesses, has been trying to reduce its near-term debt burden by $5.7 billion.

"Our ability to secure an incremental $1 billion committed line of credit from Mr. Icahn's affiliates supports our restructuring plan and helps ensure our ability to continue to serve our existing small business and middle market customers," CIT spokesman Curt Ritter said.

On Wednesday, CIT received a $4.5 billion line of credit from lenders and other bondholders who had already provided it with $3 billion in financing over the summer.

Thursday marked the last day most CIT debtholders could agree to exchange their bonds for new debt that matures later and stock. Results of that exchange have not yet been released.

The company said earlier Friday it was still tabulating the votes.

Even if bondholders approve the debt restructuring plan, the company could still file for bankruptcy protection. At the same time they were asked to agree to swap their debt, bondholders were also asked to approve a prepackaged bankruptcy plan.

The Wall Street Journal, citing unidentified people, said the exchange offer likely failed and the company would file for bankruptcy protection as soon as Sunday night.

Ritter declined to comment on the likelihood of a bankruptcy filing.

A prepackaged bankruptcy, which would have the support of major bondholders, would speed up the process of restructuring CIT's debt and allow it to return to normal operations faster than a traditional bankruptcy filing.

CIT said Icahn's $1 billion loan would be available even if it files for bankruptcy.

Icahn had railed against the company's plan over the past week, calling it unfair to small bondholders. Earlier in the week, he offered to buy CIT's debt for 60 cents on the dollar from debtholders who agreed to reject the exchange and prepackaged bankruptcy offer.

Icahn said in a statement Friday afternoon that because he changed his stance on the offer, he will buy CIT's debt from bondholders regardless of their vote.

The agreement between Icahn and CIT came after the company agreed to make some changes to its offer, Icahn said. One of his biggest complaints about the plan was it would keep the board intact. On Wednesday, CIT said it would accelerate changes to its board of directors if it files for bankruptcy.

A failure by CIT could hurt an economy already struggling to recover, especially the retail sector. The company is a short-term financier to 2,000 vendors that supply merchandise to 300,000 stores, according to the National Retail Federation.

CIT has been struggling as its costs to borrow money have eclipsed the income it generates from lending money. CIT lost its primary source of funding last year when the commercial paper market nearly collapsed at the peak of the credit crisis and has yet to recover.

Shares of CIT dropped 17 cents, or 16.7 percent, to 78 cents in afternoon trading.