Traveled overseas recently? Look carefully at your credit card bills. You'll probably see a new fee on your bills, a ding of a few dimes for every single charge you made. Frustrating, yes, but for once, this is a good thing.

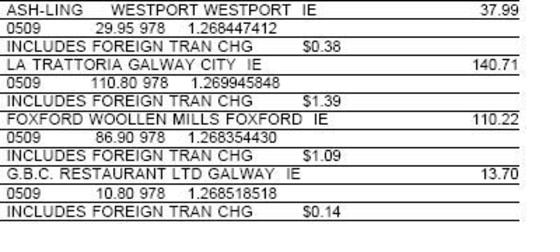

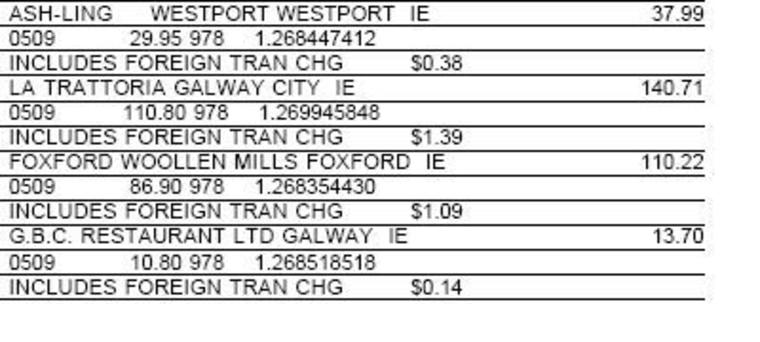

A Red Tape Chronicle reader named Russ called my attention to the fees last week. He'd gone to Canada with his wife, as he has many times, but this time, there were surprising extra dings on his bill. For example, dinner at a restaurant for $29.96, and just below it, a 30 cent charge. Russ, who asked that I withhold his name because he works for a large bank that issues credit cards, sent me scrambling for my most recent credit card bill. And sure enough, for each charge I made in Ireland recently, there was a small charge listed below labeled "foreign tran chg." Dinner for friends $140.71, fee $1.49. Scarf and sweater $110.22 -- fee $1.09. Lunch $13.70, fee 14 cents.

What's going on here? Well, it's a bit of a good news/bad news story. But if you're traveling this holiday season, there are some things you need to know.

First, the bad news. Russ is right -- for every MasterCard or Visa credit card purchase you make outside of the United States, either MasterCard or Visa sucks an additional 1 percent from consumers. It might seem like pennies, but those pennies add up. According to Thomas F. Schrag, a lawyer who filed suit against the credit card associations over such fees, consumers paid $2 billion in the itsy-bitsy traveling fees from 1987-2002.

But the bad news doesn't stop there. Credit-card issuing banks know a good revenue source when they see one. Starting around 2000, many banks began tacking on similar, costlier fees for using your credit card overseas. Today, many banks add on another 2 percent to the 1 percent charged by the credit card associations. That $100 sweater really costs you $103, if you pay with plastic outside the U.S.

But wait, there's more. Debit card fees and ATM withdrawal fees can be even higher. Bank of America charges a flat $5 for out-of-network overseas withdrawals. JP Morgan Chase charges $3 plus 3.5 percent. A $100 withdrawal costs more like $106.50.

Where's the good news?

It's hard to find good news in there, but there is some. At least we can talk about the problem. Not long ago, foreign transaction charges were one of the grand mysteries of the credit card industry. They were not disclosed by banks. Instead, the fees were merely baked into the exchange rates listed on credit card bills. Consumers who didn't have all night to play with spreadsheet, calculators, and currency conversion rates were none the wiser. The credit card associations and banks, meanwhile, were getting much richer.

A series of lawsuits has outed the practice, which is now slowly coming to public consciousness. Earlier this year, Visa and MasterCard changed the way the fees were charged, and credit card banks started listing the fees as separate entries on monthly bills. Visa cards began listing the fees separately on April 1, MasterCard on Oct. 1.

In other words, Russ did not discover a new fee last week. He just finally was told the truth. In the past, Russ's dinner with his wife would have been listed as $30.26 on his bill, with a conversion rate adjusted to include Visa's 1 percent take.

'You have to be a math genius'

Of course, many consumers still don't know about the fees, which can vary wildly from credit card to credit card. In fact, fees can vary even within the same piece of plastic. In other words, credit transactions often have a different cost than debit transaction, even if you are using the same card, says Kristin Arnold, who recently published a study of credit card foreign transaction fees for BankRate.com. Unfortunately, most consumers learn the hard way, after they are home from vacation. The confusion is profitable for banks and costly for consumers.

"You have to be a math genius to figure it out. It's meant to confuse people. It's a lot to keep track of," she said.

Finding out just how much you can expect to pay for the privilege of overseas plastic is more art than science, says Ed Perkins, author of Business Travel: When it's Your Money.

"It's really a weird situation...It's a moving target; things change month to month," he said. "Any time one banker sees another banker successfully implementing some greedy strategy, the temptation is too great not to imitate."

Get it in writing

The best strategy, says Arnold, is to call your credit card company before your trip and discuss foreign transaction fees with them. But there's a catch: the situation is so confusing, you can't count on the customer service agent to give an accurate answer, she said.

"I would not trust the person you get on the phone initially. I would ask to speak to a manager," she said. Bankrate researchers were often given conflicting answers, Arnold said. An even better idea: Tell the credit card firm to mail you your terms of agreement again, with the relevant currency exchange fee information highlighted.

In her study, Capital One stood out as levying no foreign exchange fee; the firm even absorbs the MasterCard/Visa 1 percent fee. Bank of America, which charges 3 percent for credit card transactions, does offer relief to those who want to withdraw cash from ATM cards overseas -- it's Global ATM Alliance. Member banks include Canada's Scotia Bank, Britain's Barclays, and Germany's Deutsche Bank. Consumers from any member bank can withdraw cash without paying hefty transaction fees.

Schrag is optimistic that more banks will offer fee-free solutions, now that such fees are out in the open.

"Over the next 3 to 5 years, you'll see competition erode these fees," he said, pointing to the slow, steady disappearance of annual credit card fees. "Some banks have dropped their issuer fees already. I think the 1 percent fee will eventually disappear."

But such bank fees won't go down without a fight. In 2003, Schrag won a class-action lawsuit against MasterCard and Visa foreign exchange credit card fees, with a judge awarding $800 million to plaintiffs after finding the fees ran afoul of California's unfair competition laws. The associations are appealing.

And while that appeal drags on, Schrag and colleague James Baum have filed a similar suit involving foreign debit card transaction fees. A hearing is scheduled for Dec. 15 to certify that case as a class action lawsuit.