Running out of juice just as it prepares for the most important product launch in its short history, Tesla is once again going to the well, hoping to raise $1 billion through a new stock offering.

The announcement comes just weeks after founder and CEO Elon Musk revealed a dim fourth-quarter earnings report and warned that the battery-carmaker was “getting very close to the edge” in terms of its cash reserves.

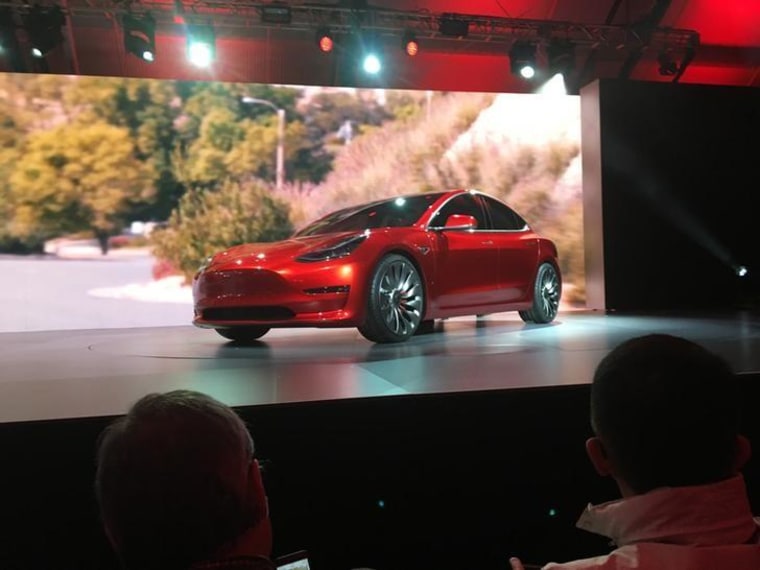

The latest stock offering, which comes less than a year after Tesla’s previous turn to the market, is meant to reduce any risks associated with the rapid scaling of (our) business due to the launch of Model 3, as well as for general corporate purposes,” the company said.

Related: Tesla 'Close to the Edge' as it Readies Model 3

The new offering includes $250 million in common stock and another $750 million in convertible senior notes. Some of Tesla’s earlier stock sales were oversubscribed — but whether that will happen this time is less certain.

Is Tesla Losing Its Shine?

In recent weeks, long-bullish analysts have started turning bearish on Musk and company, David Tamberrino, of Goldman Sachs, downgrading Tesla shares to “sell.” After the latest offering was announced, CFRA’s Efraim Levy reiterated his own “sell” recommendation.

If there was a bright side, noted an advisory from Levy, it’s that Tesla isn’t selling as much stock as many had expected — as much as $2.5 billion, by some estimates — and “lower than expected dilution (for existing shareholders) is a positive. But in our view,” added Levy, “risks persist.”

Related: Elon Musk Shares What's Next as Tesla Stock Price Jumps

The biggest risk is the upcoming launch of the Tesla Model 3, the maker's first long-range, mainstream-priced battery-electric vehicle, or BEV. Tesla says it has taken somewhere in the range of 400,000 advance registrations for the vehicle, so getting it into the market as soon as possible is critical. But Tesla has a history of missing its launch dates. It was two years behind with the Model X, and that electric SUV was beset with quality issues that depressed production at Tesla’s Fremont, California assembly plant last year.

During an earnings conference call last month, CEO Musk stressed that the sedan will go into production in July, about as early as anyone had been hoping for. But skeptics still abound. And automotive analysts like David Sullivan of AutoPacific warn that getting quality right will be just as important as delivering the Model 3 on time. Sullivan warns that mainstream buyers are, ironically, far less tolerant of defects than luxury buyers who typically have another vehicle to switch to when a car like the Model X has to go in for service.

To help shore up investor confidence in the latest stock offering, Tesla CEO Musk said he will purchase $25 million worth of those new common shares.

Market Maker

Musk has repeatedly billed the Model 3 as the breakthrough vehicle for Tesla. It certainly needs to change its numbers. While production last year nearly doubled 2015’s numbers, the Silicon Valley maker is still barely an asterisk on industry sales charts. But Musk has promised to push volume to 500,000 in 2018 and 1 million by 2020.

Margins will be significantly tighter on the Model 3, which will start at around $35,000 after factoring in the federal $7,500 tax credit. But at the sales levels promised, Tesla is expected to finally land solidly in the black. It has turned a quarterly profit only twice since going public. And while it was able to halve its deficit, year-over-year, it still lost $121.3 million, or 78 cents a share, during the final quarter of 2016.

Another challenge for Tesla is the integration of Solar City, the solar cell company it now owns following last year’s controversial acquisition.

Observers have also expressed concerns that Musk’s attention is getting spread thin. He not only owns Tesla but the rocket launch company SpaceX. And he serves on two economic advisory boards set up by President Donald Trump. A boycott against Tesla launched in protest of Musk’s ties to the GOP White House resulted in the cancellation of a small number of Model 3 reservations, Tesla confirmed last month.